There’s no such thing as an undecided voter.

They’ve either decided, or decided to do something bad and don’t want you to judge them.

There’s no such thing as an undecided voter.

They’ve either decided, or decided to do something bad and don’t want you to judge them.

Amusing as that is, I’m pretty sure it’s happened in every war since time began, and will continue to happen until we’re back at sticks and stones.

It’s easy to assume that everyone that disagrees with us is stupid, but I can assure you that’s very much not true.

I’ve seen otherwise very intelligent people lost down the rabbit hole of right-wing fuckbaggery. I think it’s often just a slow burn from social media. I saw a video earlier today about an ancient tool for spear throwing, and was immediately afterwards presented with a video about how the new Dragon Age game is ruined by DEI…

And the saddest thing is, most people on the extremes have started at the same place: An unhappiness with their own life and a search for a solution. They’ve just ended up at vastly different positions, in that the right has chosen to blame the nebulous “others” below them, while the left has chosen to blame the “others” above them. And punching down is always an ugly look.

In fairness if it had a microwave oven in the 60s, I’d probably want a warning if I was just near that building.

It was not a time when things were tested for long-term safety…

Sanction them.

No.

It’s likely the site itself is now a load of dirt mounds in the vague shapes of buildings and then covered with trees.

It’s certainly several orders of magnitude better than Blessica…

Although mythological names are often cool, it’s always worth researching fully. Loki may suddenly be super cool thanks to the MCU, but he still got fucked by a horse.

So they can make as much money as possible

Gaston makes fried eggs.

I mean, I work in IT. It’s hard to take a bunch of sweaty Humpty Dumpties seriously when they tell you the issues with BMI…

You lower it in the kitchen I think, regardless of your build. I think if you’re healthy, you know how much to pay attention to a single number.

Well it incentivises neither.

I’ll admit I was disappointed that I put on weight once I worked out a bit, but there’s still plenty of podge to go before I can blame BMI for me being slightly overweight.

For all the time I’ve been told how bad BMI is, and how it classes top athletes as obese, I can’t help but notice how few of those people have the body of a top athlete.

If my wife bought a cute dress and only wore it once, I’d be annoyed af.

“Fast fashion” is a plague of waste. Wear your shit until it falls apart.

I don’t think Britain ever got out of being poor, and that at least had something to do with Brexit happening. Sure, there’s London with it’s finance people doing things that make money without actually needing to do any work, and other big cities do OK, but the rest of us scrape by. Former mining towns, former manufacturing towns… None of these places came back to life. They’re not anything now. Just former something towns. And by and large, they voted for Brexit to happen. It wasn’t a particularly sensible decision, but there you are. More of a protest vote that got out of hand.

That said, I think Portugal is still poorer by a long way. I lost count of the number of times I clicked Brazil while playing Geoguessr and it turned out it was Porto or something. It’s an East Europe country that happens to be in the west.

I find it helps if you just call them “invaders”.

I think you could only call yourself a settler if you went somewhere uninhabitable and made it livable. Antarctica maybe. I don’t think “arable farmland right next door with brown people living on it” counts for much.

This is what happens when everyone follows the same Hitman walkthrough.

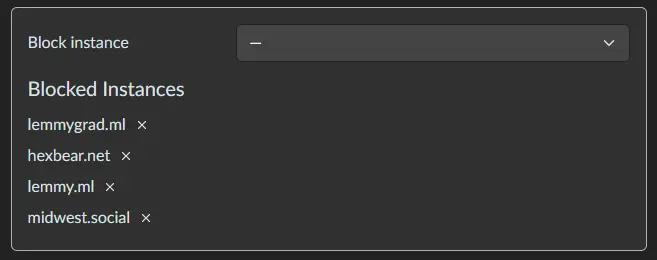

Usual tankie nonsense masquerading as progressivism.

Call out their bullshit, get a ban.

The path to inner peace.

Doubt it. The US has an even bigger hard on for Iran than Israel does.

They’re populists.

They see which way a crowd is running and jump in front, shouting “follow me!”