This part confuses me. Wouldn’t this be a good thing?

“Worsening the situation, 45pc of landlords decided to sell their properties in the wake of the announcement significantly reducing the amount of accommodation on offer and further pushing up prices.”

Yes, the number of rental properties declines, but that would mean home ownership would increase, right? I know my bias is toward the North American model of a multiyear fixed rate mortgage. I also know that the model exists in Europe about essentially interest only mortgage where you never actually pay down your mortgage, but your interest payments are essentially your housing costs.

How does it work in Argentina? How do people buy houses? Are they instead all cash transactions or do mortgage schemes exist there in some form?

Not not good. Means there is no money to be made in renting and less houses will be built because of it.

Ultimately it is a supply and demand issue. Long term effects are more important in the housing market than short ones. These are short term effects.

Not not good. Means there is no money to be made in renting

Right, because of the government imposed price cap. The article covers that.

and less houses will be built because of

Where does this part of the idea come from? There’s no price controls on buying or selling housing, therefor should be no negative impact on the market. Further, the price of homeowners buying housing should have been temporarily cheaper because landlords were unloading properties instead. Private home ownership is a really good solid foundation for an economy.

True in fact property prices are at An All time low now in Argentina

My English is not the best but I believe, given the weird way this was redacted, that are talking about what happened with the previous leftist government:

`The rules, introduced in 2020 by then-president Alberto Fernández, included a mandatory lease term of three years and a limit on rent to an average growth rate of the consumer price index and the wage index. This cap was set by the central bank.

Even before the new legislation came into force, the effect was significant. Unsure of how much and when they would be able to increase rents, landlords hiked their pieces to try and avoid being caught out.

Worsening the situation, 45pc of landlords decided to sell their properties in the wake of the announcement significantly reducing the amount of accommodation on offer and further pushing up prices.`

Because this did happen with the previous government when they instated the rent controls.

Now after Milei’s deregulation, we have more rent offer than ever, which allowed for a market dinamic. People now can choose where to rent with in turns let’s the prices lower as rentals have to compete with each other’s

My English is not the best but I believe

First, your English is very good!

I am understand why landlords sold (when the price caps on rents were put in place).

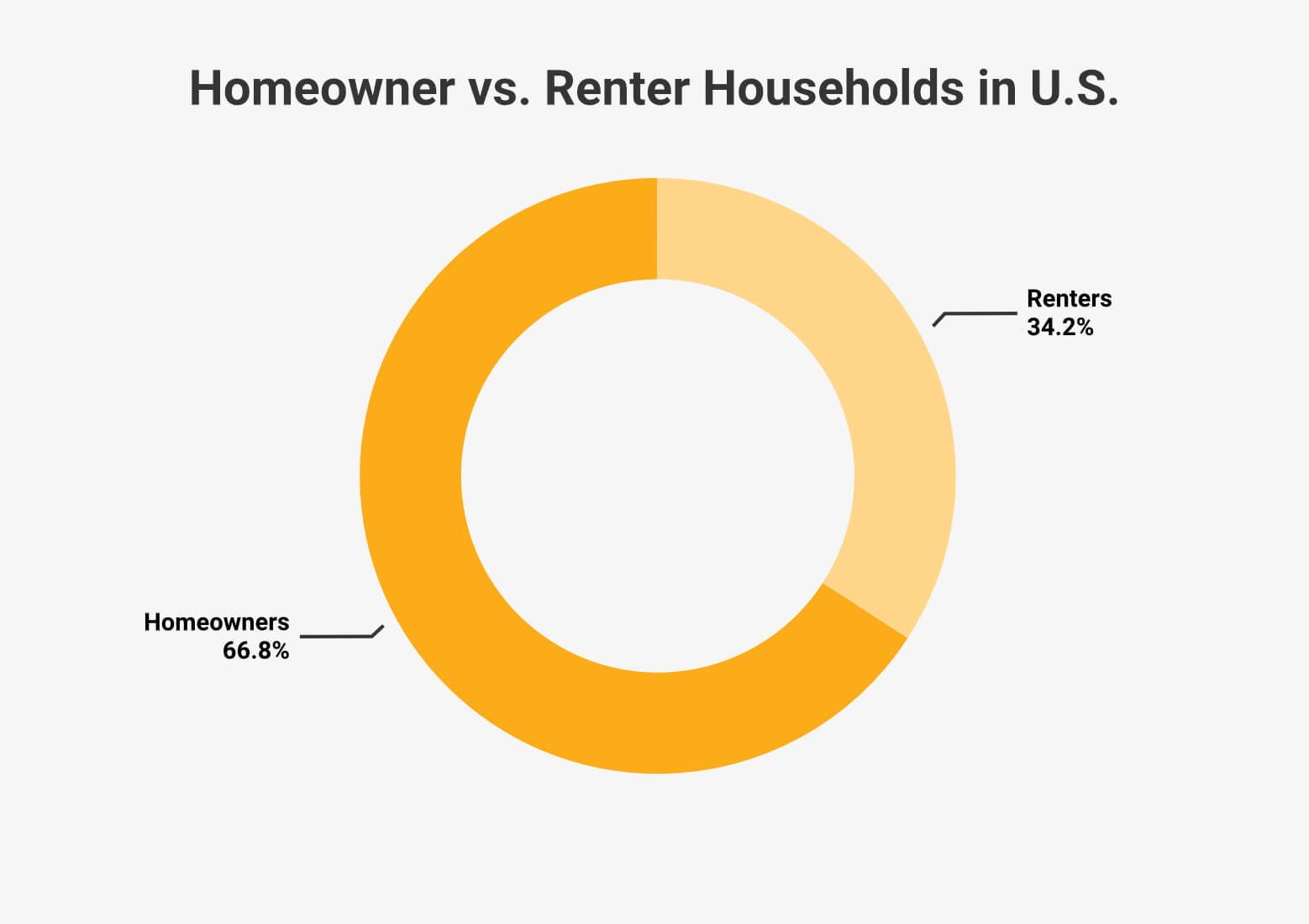

I’m wondering if I am not understanding how people in Argentina pay for housing. In the USA most people buy the homes they are living in for housing:

Purchases of homes are either done in cash (more rare) where the buyer owns the home entirely at the time of purchase, or they get a loan from a bank (a mortgage) usually spanning 15 or 30 years. If they are borrowing from a bank, then they must pay a portion of the loan and interest back monthly. This is the mortgage payment. At the end of the 15 or 30 years, the buyer owns the home entirely themselves and does not have to make a monthly payment on their home. I’m simplifying this a bit and ignoring that homeowners need to pay monthly insurance and taxes on their homes usually.

Those that either cannot afford to buy their home (or choose not to for other reasons) pay a monthly rent to the owner of the property (landlord).

Is this the same way people pay for their housing in Argentina, or does it work differently?

Most people here cannot save enough for a down payment for a house /department. So the only solution are mortgages. Little problem is that mortgages have been absent in anything but paper so Argentines have not been able to acquire property or housing with ease since years ago

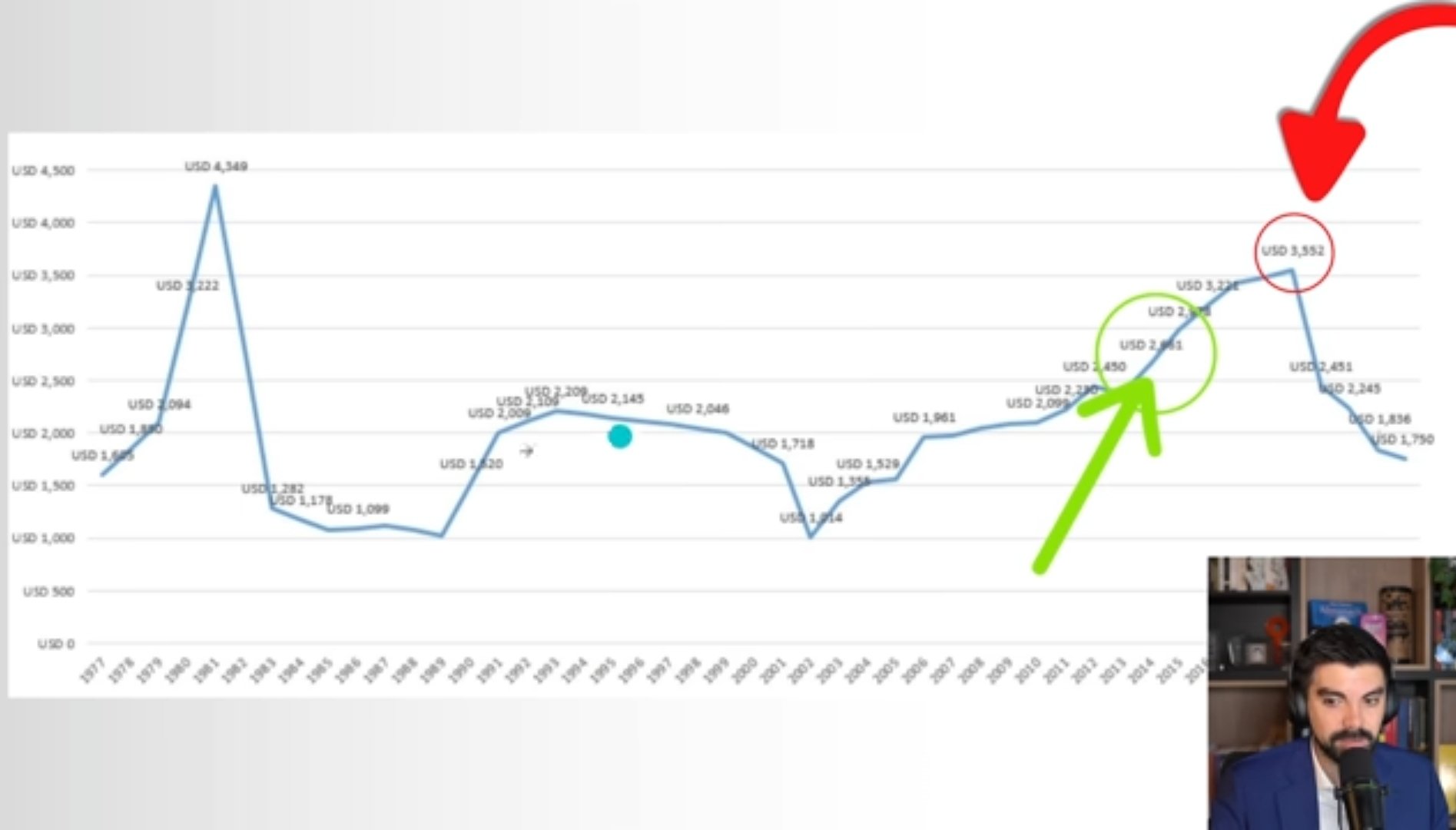

Last time mortgages were available, it was in 2017/2018. After the currency devaluation that came on 2018/2019, banks, understandably, faced towards different ways of earning interest on their capital savings. Banks turned to high interest, high yield governmental bonds during the last 4 years, which was the way the leftist government found to capture all the extra pesos they were printing thrift the central bank daily to subsidize everything from food to services.

Little problem? The interest rates implied that the central bank had to pay even more pesos to the banks every time. So to avoid paying in an unpredictable bank run, they kept increasing the interest rate, therefore the banks would keep their money on the aforementioned bonds, the interest would increase, then to avoid an unpredictable bank run, the government would increase interest rates again and so on.

It was a literal trap.

But that explains why banks would not loan money for mortgages. Why would they if they had the government at their service printing money for them?

It’s not for nothing that the arrival of Milei is so celebrated by the 57% voting population. They guy literally saved us from hyperinflation.

Now thanks to Milei, banks now have to work and earn their money through real lending, not just interest rates being hiked at the expense of the people

Lol.

Its actually a really interesting article. But it goes against what people want to be true with what is actually true.

People are down voting this because they want to live in fantasy land. Can we not actually upvote things that are informative and in areas where people knowledge is lacking. This article can be a learning point for you all or you can all live in denial.

Thank you for your nuanced take